Supporting local business growth and regeneration

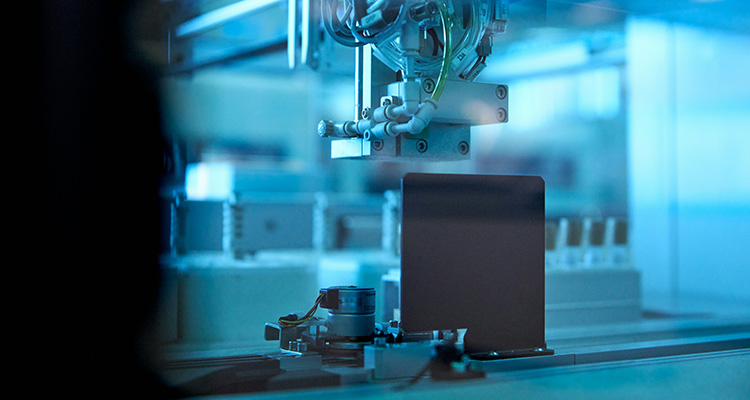

December success story This month, we are delighted to share how NGI Finance supported a 30-year-old manufacturing business in securing long-term stability and future growth by purchasing their trading premises. Over the past 7 days we have successfully arranged and completed a £3.5 million commercial mortgage, enabling the business to buy the property from their…

read more