Explaining business loans

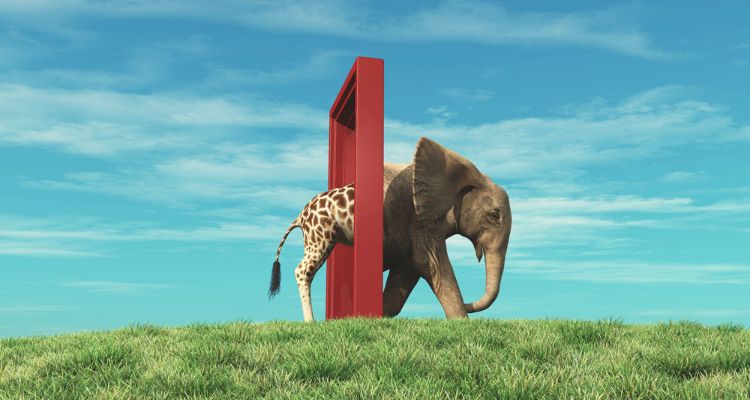

Businesses must adapt, whether it is to a change in supplier, a change in customer demographics, a change in manufacturing process or indeed a change in staff, the need to be flexible and overcome challenges is essential. Often the one critical factor that can determine how successfully a business can adapt is working capital. Any…

read more