Scaling operations requires investment and for many businesses, equipment is at the heart of that growth. From machinery and vehicles to technology and specialised tools, having access to the right assets at the right time can directly impact productivity, efficiency and competitiveness. Equipment financing provides a practical way to acquire these essential resources without draining cash reserves.

Why equipment financing matters

Purchasing new equipment outright can be costly, tying up capital that could otherwise be used for hiring, marketing or other growth initiatives. This is where equipment financing is so beneficial. It spreads the cost over time, allowing a business to preserve working capital while still expanding operational capacity. This approach ensures that growth isn’t stalled from the outset due to financial constraints.

Supporting phased growth

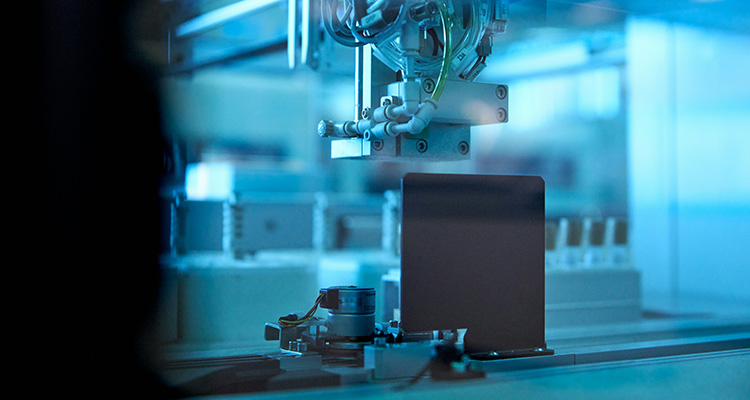

Many businesses scale gradually, introducing new products or expanding to new locations in stages. Equipment financing allows businesses to acquire what’s needed at each stage without overcommitting financially. For example, a manufacturing firm can lease additional machinery as production demand increases, while a logistics company can expand its fleet incrementally to match client growth.

Maintaining competitiveness

Outdated or inefficient equipment can slow operations and increase costs. Financing enables regular upgrades, ensuring that a business stays competitive in its sector. Whether it’s adopting new technology in healthcare, modernising machinery in manufacturing or upgrading vehicles in logistics, equipment financing allows businesses to keep pace with industry standards and customer expectations.

Flexibility and tax efficiency

Many equipment finance solutions offer flexible repayment options and ownership structures. Depending on the product, businesses can choose to lease, hire purchase, or refinance, tailoring the arrangement to cash flow cycles and operational needs. Additionally, some financing arrangements can provide tax advantages, making it more cost-effective to acquire essential assets.

In summary

Equipment financing is more than a way to purchase assets; it’s a strategic tool that enables sustainable growth. By providing access to necessary resources, preserving cash flow and offering flexibility, it allows businesses to scale operations efficiently and maintain a competitive edge.

For advice on how equipment financing could support your growth plans, call us on 01993 706403 or e-mail enquiries@ngifinance.co.uk.