There are several finance options for businesses that operate within the healthcare and medical sectors. Solutions include both secured and unsecured facilities with flexible repayment. Let’s explore some of the most common reasons for funding:

Day to day operations – running a healthcare business can be expensive, you need state of the art equipment, comfortable working environments, highly qualified staff and reliable transportation. All these elements result in high daily operational costs and at times a business might need to call on finance to maintain a healthy cashflow and ensure daily, weekly and monthly payment commitments can be easily maintained.

Stock – certain healthcare providers will require a large stock of medicine. Not only is the purchasing of these items expensive but they will also need to store safely and securely. Using stock finance can be very advantageous.

Business premises – there are several business premises required, depending upon the specific role of the organisation. There might be a need for a manufacturing plant, a pharmacy, a GP surgery, a dental surgery, a rehabilitation centre or a prosthetics clinic. Securing the future of the business through the acquisition of a commercial property is incredibly important. There are some excellent commercial property finance solutions available for this.

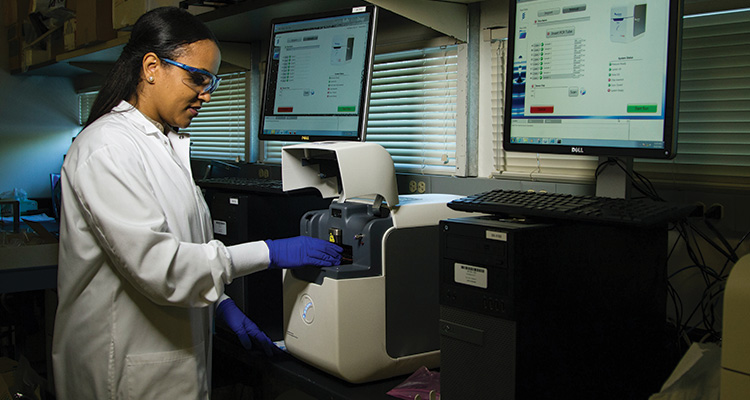

Medical equipment – healthcare is about ensuring the very best standards of care and therefore there is a heavy reliance on ensuring the business has the right tools and infrastructure to achieve this. Business finance can be used for machinery purchase, technology upgrades, research and development initiatives, new product launches and much more.

Property development – on occasions investment will be needed to either increase the size of the existing commercial facility or to locate a new and larger site. In order to complete either the extension or new purchase, business finance will be required and a commercial mortgage can be the ideal solution.

Business acquisition – often the best form of business growth is through acquisition. This could be the purchase of a competitor or a complementary business. Typically, a large financial outlay will be required which is where the use of acquisition finance can be deployed.

Here at NGI Finance, our team of finance specialists have broad experience in working within the healthcare sector. Recently we have supported a dental surgery in Southampton to purchase a second facility thanks to £700K of business finance. We have also enabled a care home acquisition in Reading to the value of £400K and assisted with the purchase of a domiciliary care business in Oxford worth £150K.

To find out more about healthcare finance please call us on 01993 706403 or e-mail enquiries@ngifinance.co.uk.